OVERVIEW

The Options Chain

Options are financial derivatives that give buyers the right, but

not the obligation, to buy or sell an underlying asset at an

agreed-upon price and date. As a buyer, If you buy an option you’ll

pay a premium to the sellers for the right to own the contract. As a

seller, you’re taking on an obligation, so whatever happens you earn

a premium from the buyer.

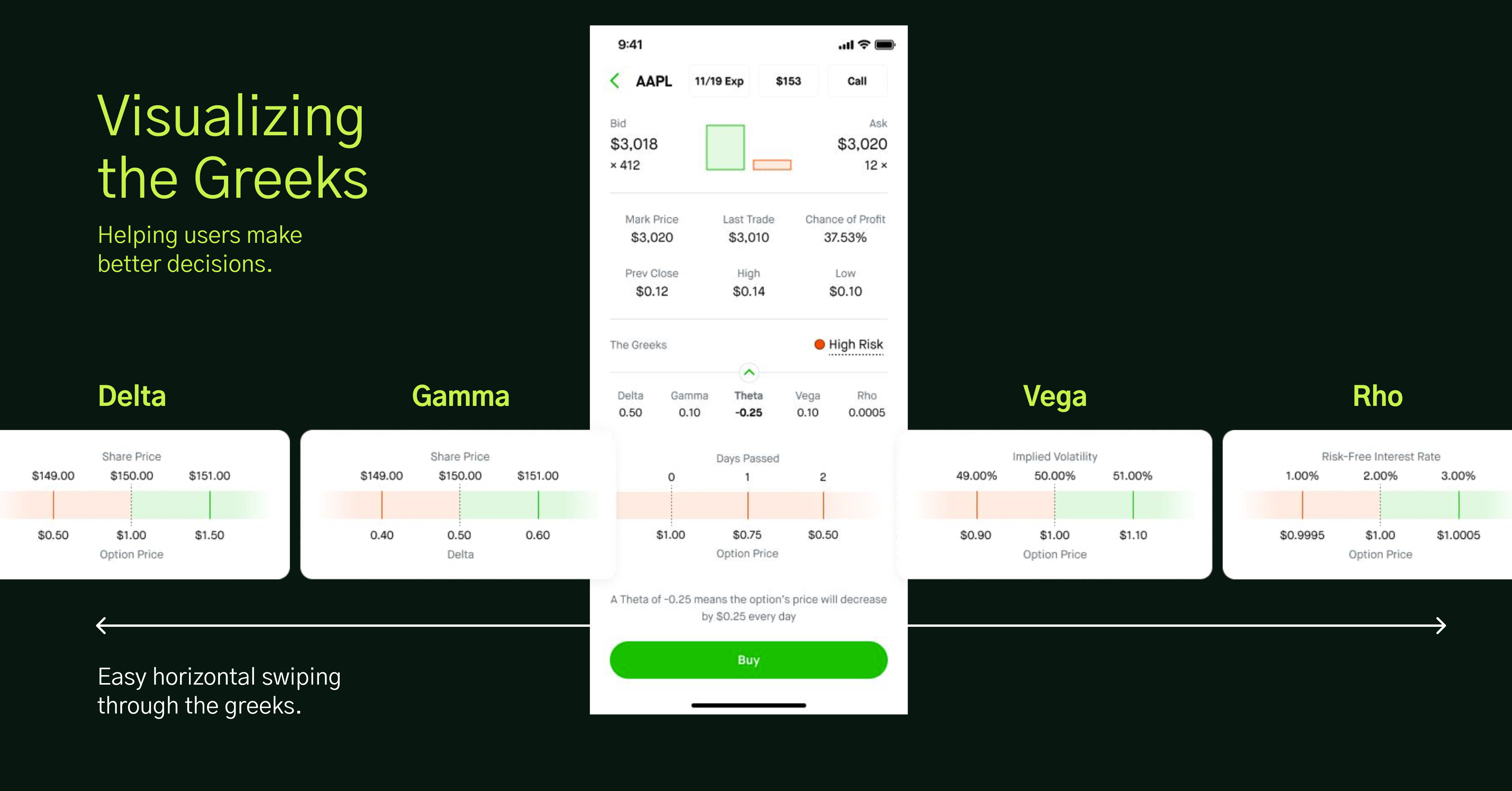

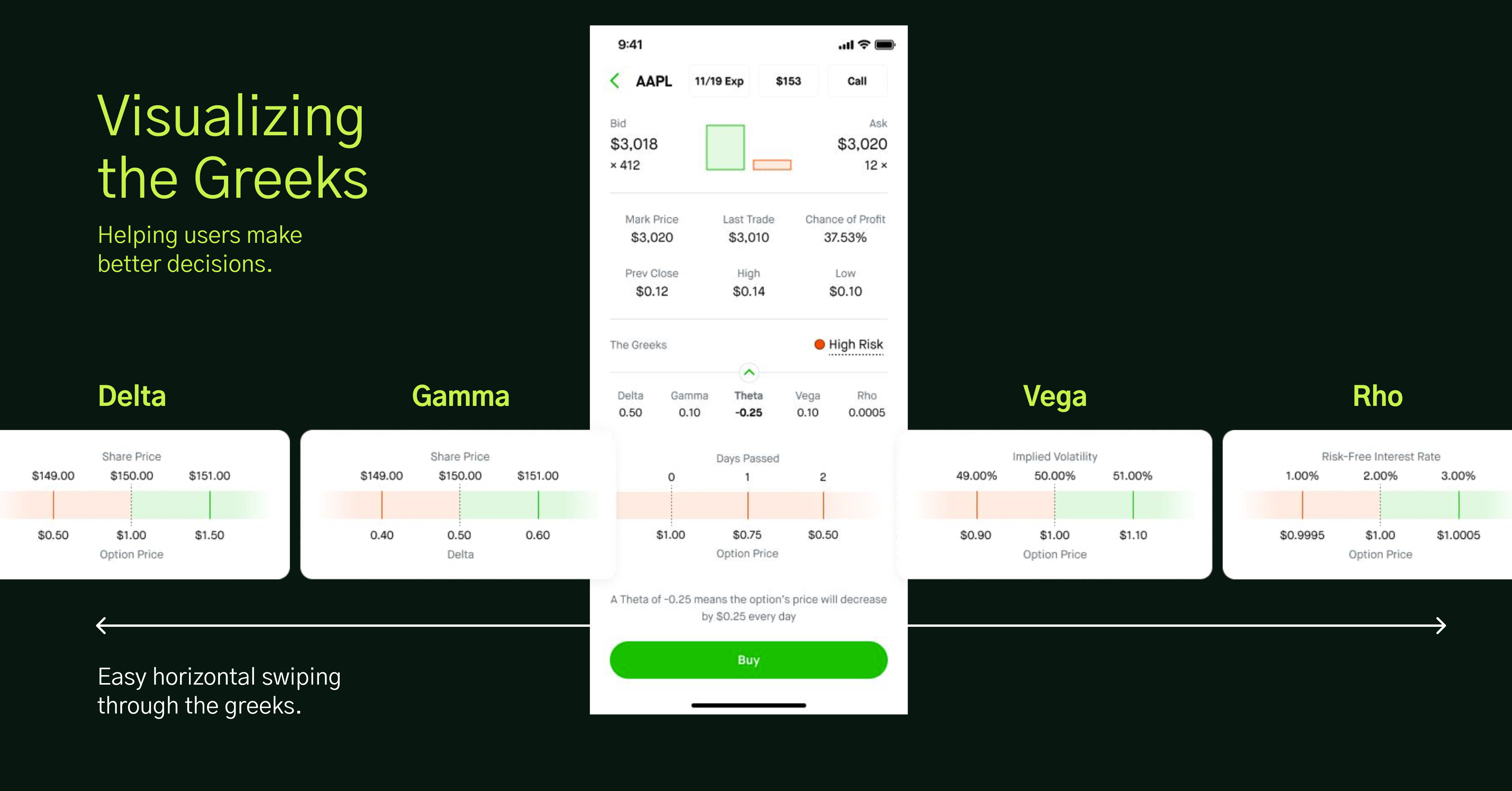

The Options Chain is a listing of all available options contracts

for a given security. It shows all listed puts, calls, their

expiration, strike prices, and volume and pricing information for a

single underlying asset within a given maturity period. Robinhood's

option chain page has not evolved in a long time. User needs have

shifted and there are improvements that can be made to the data

displayed for each contract. I explored different ways we can

redesign the chain and bottom sheet on mobile with different sets of

data.

*Below is a key feature that I designed. However, I am not able

to show a larger breadth of my work here, please contact me

directly if you would like more information regarding this

work.*